The Anchor Beyond Time

At British Gold Trust, physical gold is securely held under sovereign custody and governed by rigorous fiduciary standards – not merely as an asset, but as the foundation of a resilient GoldTech ecosystem built on trust and transparency

This is not an investment product,

It is the foundation of an alternative monetary architecture.

- We do not speculate

- We do not outsource

- We do not promise returns

We hold gold – because gold holds truth

Why Gold

Uninflatable

Gold cannot be printed. Its scarcity is not policy – it is reality.

Uninterrupted

For five millennia, gold has carried value through the collapse of empires and the illusion of progress.

Unmediated

We extract and secure our own gold. There are no intermediaries – only stewardship.

Uncompromised

Stored at securely stored in world-class, high-security vaults under daily audits. No derivatives. No paper claims.

Universal

Gold needs no passport. It speaks the language of value everywhere, and always has.

In a world governed by algorithms and abstractions, we return to the one element that does not decay.

Not because it is old – but because it is incorruptible.

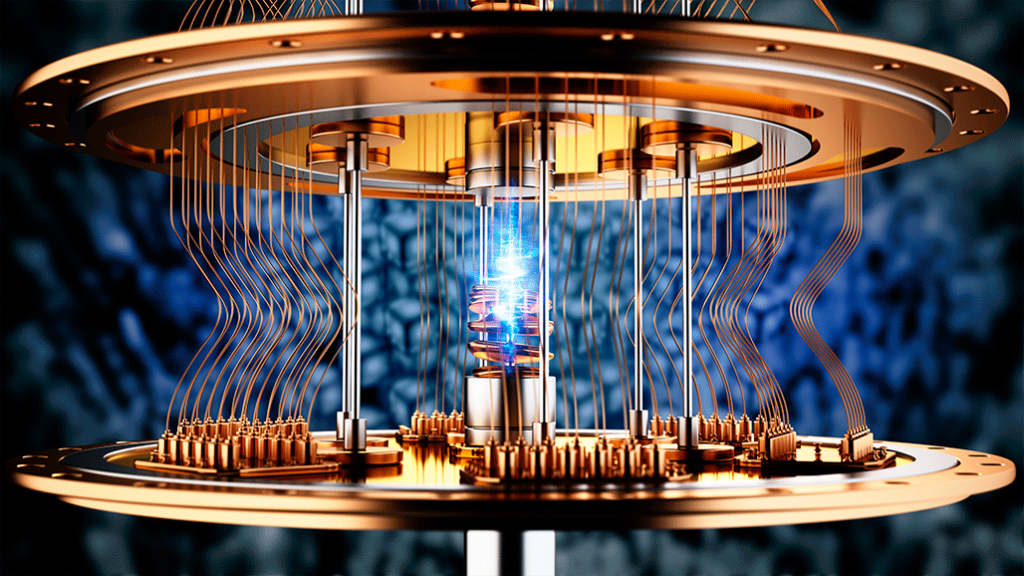

tokenization

Reactivating Gold – Without Compromise

Gold is perfect in nature, but limited in motion. To serve as a living financial instrument, it must become usable without being exposed. That is the purpose of tokenization.

In our system, tokenization is not a financial gimmick.

It is a technical shield – enabling secure, sovereign interaction with real, allocated gold.

Each token:

- Represents a verifiable claim on physical gold held in Trust

- Is mapped one-to-one to audited reserves

- Cannot be duplicated, manipulated, or repurposed

- Exists only within our private, closed-loop ecosystem

Each token derives its value from:

- Gold (50%): LBMA-certified bars stored in world-class, high-security vaults.

- Energy (20%): Solar/wind farms (certified by CER).

- Real Estate (20%): Commercial/residential properties (appraised quarterly).

- Natural Resources (10%): Water rights, arable land, timber.

Aurum silentium loquitur

We use a custom blockchain protocol, hardened with post-quantum cryptography, ensuring that transactions remain:

- Immutable

- Untraceable

- Legally meaningful

Unlike cryptocurrencies, these tokens are not speculative assets.

They are instruments of access – giving verified participants the ability to use gold without moving it, to settle without clearinghouses, and to preserve privacy without sacrificing legality.

Gold remains in the vault. Value flows through the system – instantly, securely, and with zero counterparty risk.

goldtech

A Financial System Without a System

GoldTech is not an app. Not a wallet:

It is a sovereign layer – a closed financial architecture where gold functions as currency, shielded by trust law and fortified by cryptographic infrastructure.

No fiat. No exchanges. No intermediaries.

Participants interact directly, under private legal agreements, using tokenized gold as a unit of account, settlement, and value transfer – without touching the legacy financial grid.

GoldTech enables:

Private settlement in gold – peer to peer, trust to trust.

Legacy protection – with programmable rules for inheritance and allocation.

Structural confidentiality – with legal and technical safeguards at every layer.

Regulatory insulation – through non-public, non-custodial architecture.

This is not DeFi. This is post-finance.

Anchored in hard assets, governed by real law, protected by code.

The age of fiat abstraction is ending.

We are building what comes next – measured in gold, not debt.

Gold is money. Everything else is credit.

– J.P. Morgan