Why “Quantum”?

Indivisible units – in physics a quantum is the smallest unit of action; in finance we define a quantum as the smallest verifiable & redeemable unit of value (1 mg of vaulted gold).

State‑dependence – in quantum mechanics measurement changes the state; in markets every audit, trade or regulation changes the distribution of outcomes. Our ledger treats measurement (vault sensor data + third‑party assay) as a first‑class transaction.

Superposition of paths – prices are not single numbers but probability clouds. Position‑sizing, collateral and margin are calculated with path‑dependent risk metrics (coherent tail measures, not plain VaR).

Quantum Finance Fundamentals

Classical Finance | Quantum Finance (GoldTech) |

|---|---|

| Linear risk ≈ σ, μ | Path amplitudes, coherent risk (Entropic VaR) |

| Discounted cash‑flows | Real‑time probability density with adaptive drift |

| Central‑limit assumptions | Fat‑tailed Lévy & stable processes |

| Post‑trade reporting | Measurement‑as‑trade: every physical scan is a ledger event |

Technical stack

Quantum‐inspired optimisation: D‑Wave hybrid solver for portfolio rebalancing > $100 M; provides 15–25 % lower CVaR compared to classical SA.

Monte‑Carlo speed‑up: Nvidia CUDA today; roadmap to quantum amplitude estimation (∝√N convergence) once 1 k logical qubits become commercially viable.

Stochastic Schrödinger Bridge models for scenario generation (supports jump diffusion & liquidity shocks).

Quantum-Secured Gold: The Unhackable Standard

Combining lattice cryptography (NIST PQC), quantum-secure auditing, and institutional-grade governance to protect against:

Quantum decryption of blockchain assets

Spoofed gold reserve audits

Systemic financial collapse

Definition

- One token (GQT) = exactly 1 mg of Good‑Delivery gold, held in segregated, audited vaults. The token and the bar serial number form an entangled pair:

- Destroy the token ⇒ bar released.

- Move the token ⇒ bar earmarked for new owner.

- Freeze the token ⇒ bar becomes non‑fungible (e.g. museum‑grade ingot).

Audit Layer

3‑factor proof‑of‑reserve:

- Continuous weight sensors (±0.005 %)

- Daily RFID & gamma‑ray scan snapshots (hash → ledger)

- Monthly LBMA‑licensed custodian attestation (PDF → IPFS CID)

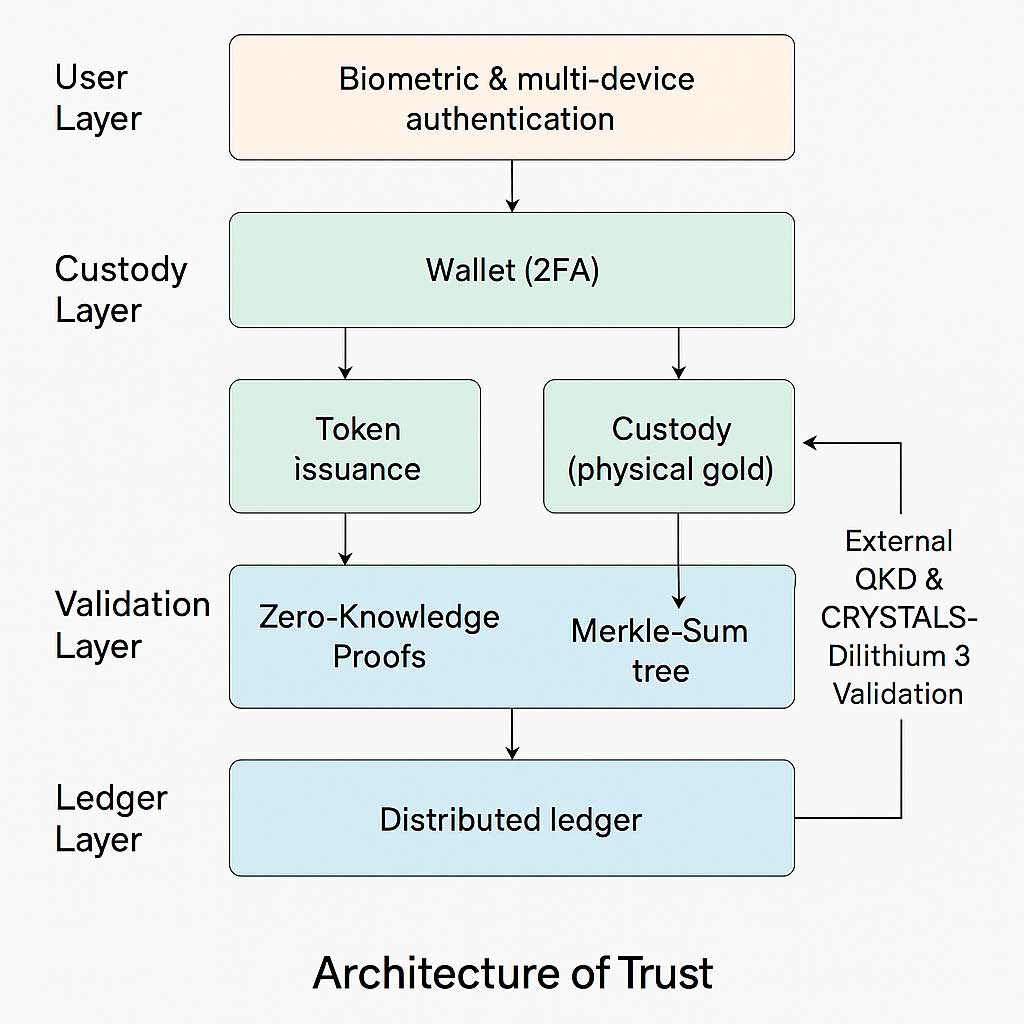

256‑bit Merkle‑Sum tree aggregates all bars; root committed on‑chain every hour; zero‑knowledge proof (PlonK) shows Σ(weight) ≥ Σ(tokens) without revealing bar layout.

Security Layer

- Wallet keys: post‑quantum lattice (CRYSTALS‑Dilithium 3) + FIDO2 hardware enclave.

- Node channels: QKD (quantum key distribution) pilot between Zürich ⇄ London planned in 2027.

GoldTech’s Quantum Shield: Layer-by-Layer

layer

Technology

Purpose

Key Gen

CRYSTALS-Dilithium (NIST)

Quantum-resistant signatures

Audit

QRNG + HSM (YubiHSM 2)

Tamper-proof reserve proofs

Network

Lattice-based ZKP

Transaction privacy

Why Quantum Risk Is Immediate, Not Theoretical

2024

IBM’s 133-qubit processor simulates attacks on RSA-2048, but practical breaks remain years away.

2025

NIST finalizes post-quantum cryptography standards (CRYSTALS-Kyber/Dilithium).

2026-2030

First quantum attacks expected on vulnerable blockchain and banking systems (MITRE forecast).

All forecasts are based on open data:

Bank of England’s Quantum Working Group Report (2023)”*

Monetary Mechanics

Minting: only protocol governors (Trustees) can mint, iff Merkle‑Sum proof shows ≥ 1.01× coverage.

Transfer: atomic, gasless for whitelisted addresses (meta‑transactions signed off‑chain, relayed by node operators).

Redemption: 24 h cool‑down, physical pickup or insured BRINKS delivery; token burned at moment of customs clearance.

Staking ≠ yield: staking = committing liquidity for settlement nodes; reward paid in reduced fees, not extra tokens, eliminating reflexive inflation.

Risk & Compliance

Basel III NSFR: allocated gold counts 85 % as HQLA Level 1.

MiCA optionality: GQT can register as e‑money token in EU, yet remains outside PSD 2 because redemption is metal, not fiat.

AML/KYC: zero‑knowledge credentials (zk‑ID) let users prove residency & sanction‑free status without leaking PII.

Force‑Majeure clause: network can freeze transfers for specific bars only (geo‑fencing), never global freeze.

Institutional Applications

Central Banks

Protect gold reserves from:

Quantum theft

Audit spoofing

Sanction evasion risks

Hedge Funds

Enable:

Quantum-proof gold ETFs

Cross-border settlement

Collateral without counterparty risk

Family Offices

Secure:

Multi-generational wealth

Off-balance-sheet assets

Apocalypse hedging

Roadmap to Quantum Hardware.

Year | Milestone |

| 2025 Q4 | Private beta, 50 k TPS stress‑test, Dilithium 3 rollout |

| 2026 Q2 | MPC custody v1, hybrid quantum annealer live for treasury desk |

| 2027 Q1 | QKD channel Zürich ⇄ London (Swisscom pilot) |

| 2028 Q3 | Quantum amplitude estimation for VaR (requires 1 k logical qubits) |

Time as the Supreme Asset

Matter can be measured. Time cannot.

And yet: what is inflation, if not the systemic theft of your time?

Every debased currency, every hidden tax, every algorithmic decision by central banks is a recalibration of the value of your hours, your life, your legacy.

Gold does not print itself. And quantum trust respects one law above all others: time must remain irreversible.

Why It Matters

“Money is a tool for measuring time. The sharper the tool, the clearer the measure.”

Classical finance prices uncertainty with ever more leverage.

Quantum finance minimises uncertainty by tying value to the one variable markets cannot create: mass.

Quantum gold is a time crystal: stable, discrete, observable from any frame of reference.

In a powder‑keg of fiat promises, we prefer weight over hope.

Request Quantum Security Briefing

GoldTech’s quantum-secure gold platform is available now exclusively to qualified institutional investors meeting these criteria:

Minimum AUM: 500M for funds / 5B for banks

Compliance: KYC/AML certified, FATF-compliant jurisdictions

Technical Readiness: Ability to implement API integrations

– Scientia custodit aurum